Hundreds of firms, thousands of users tell us they prefer using AssetQ since it offers complete, consistent and independent due diligence information in a standard format for any available fund. A single point of access to detailed, accurate information and fund provider documents – all necessary to evidence your due diligence. AssetQ eases fund assessments, offers timely notification of change and improves levels of regulatory compliance.

A standard for the asset management industry, simplifying the ever evolving due diligence landscape. AssetQ is a proven global platform reducing the effort to service client due diligence requests whilst providing feedback on client interest. Market-wide adoption has helped make AssetQ the standard for asset managers and fund buyers alike.

Clients tell asset managers they prefer to receive their due diligence information via AssetQ’s standard presentation. AssetQ delivers efficiencies not previously possible, whilst also helping the asset manager improve levels of client responsiveness and service. Interactive services facilitate closer levels of interaction between the asset manager and their clients.

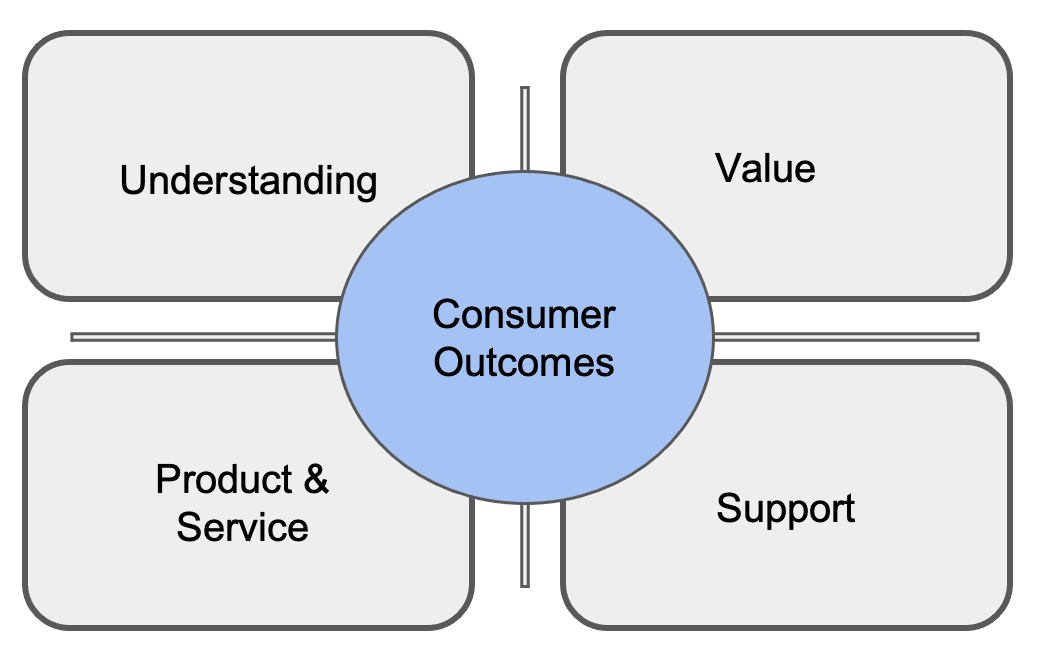

The FCA’s new consumer duty (CD) represents what the regulator terms a “paradigm shift” in its expectations of firms. The 3 cross cutting concerns and the 4 outcome areas provide a useful framework for addressing consumer safeguarding. This year we have, like many of our clients, been keen to understand the implications.

AssetQ has been a consumer driven initiative since inception, so the FCA consumer duty rules, to a large extent, codify many of our guiding principles and existing functionality. There are however a number of areas where we believe we can further enhance the platform to allow distributors and manufacturers demonstrate their adherence to both the rules and the spirit of the new regime

So whether you are a fund manager seeking to ensure distributors have the right support for your products while also garnering their feedback, or an advisor/platform seeking to validate the suitability and value of funds for your customers – we have new and innovative tooling designed to cover you.

Contact Us for a demo or simply a chat on Consumer Duty.

Companies that act responsibly towards the environment, care about societal impacts of investment decisions, treat corporate governance responsibly, and operate long term sustainable business models are well positioned to add value for shareholders.

If it’s important to you and your clients to invest in businesses that try to have a positive impact on the environment, a sustainable impact on society without pretence, then we think we can help.

AssetQ provides all the detailed information you need to assess the Environmental, Social and Governance (ESG) credentials of a fund irrespective of your strategy, be it ESG integration, Socially Responsible Investing (SRI), inclusionary or exclusionary investing, we can help you avoid ‘greenwashing’.

If you want to see the big picture on ESG, get the information you need to assess the suitability of any fund, analyse the responsible investing approach to funds which are not ESG focussed, or would like a sample of ESG fund information, just enter your email address / contact details HERE and let us guide you.

Due diligence, by its very nature, needs to be independent, free from bias and obfuscation. AssetQ is free for asset managers wishing to respond to due diligence requests; ensuring information disclosure meets the needs as defined by the fund buyer community.

Please fill out the form and press the submit button.